Anyone who has a loved one with special needs is necessarily concerned about what they can do to ensure their loved one will be cared for if no one is around to assist. Fortunately, there are certain steps you can take to provide for your loved ones through your estate planning, which can help to protect them legally and financially. Here are five things you can do to protect your loved one with special needs:

- Apply for SSI/Medicare

- If you have not already done so, it may be a good idea to apply for Supplemental Security Income (SSI) and Medicare benefits for your loved one with special needs. This can help ensure that your loved one has access to some income to help pay their bills, as well as medical coverage to help with their needs. That way, you are not covering the costs of caring for them alone.

- Obtain a legal guardianship

- Because people with special needs generally have difficulty handling complex legal and financial matters, it is often a good idea to obtain legal guardianship for them. A guardian can handle personal and financial matters, and can also make medical decisions on behalf of your loved one, if needed. This is especially crucial if you fear you may not be around to care for your loved one.

- Create a special needs trust

- Another potential tool for helping your loved one is to create a special needs trust. This type of trust places property in the custody of a trustee or trustees, who manage the assets on your loved ones’ behalf. That way, you can ensure that your loved one with special needs will not be taken advantage of by people who might exploit them financially.

- Create an ABLE account

- An Achieving a Better Life Experience (ABLE) account is a type of savings account created for people with disabilities and their families. This account receives certain tax benefits that protect the money in Able account from being taxed by state or federal authorities. This can help you to set aside money for your loved one so you know they will always have enough money to pay for their needs. Eligible individuals and their families will be allowed to establish ABLE savings accounts that may not affect their eligibility for SSI, Medicaid and means-tested programs such as FAFSA, HUD and SNAP/food stamp benefits.

- Write your preferences into your will

- In your last will and testament, you can designate how you want your loved one with special needs to be cared for, thereby ensuring there is no legal issue over their care or custody when you pass away. However, to know exactly how to set up your estate plan to protect your loved ones, you should speak to a lawyer with experience handling estate law matters.

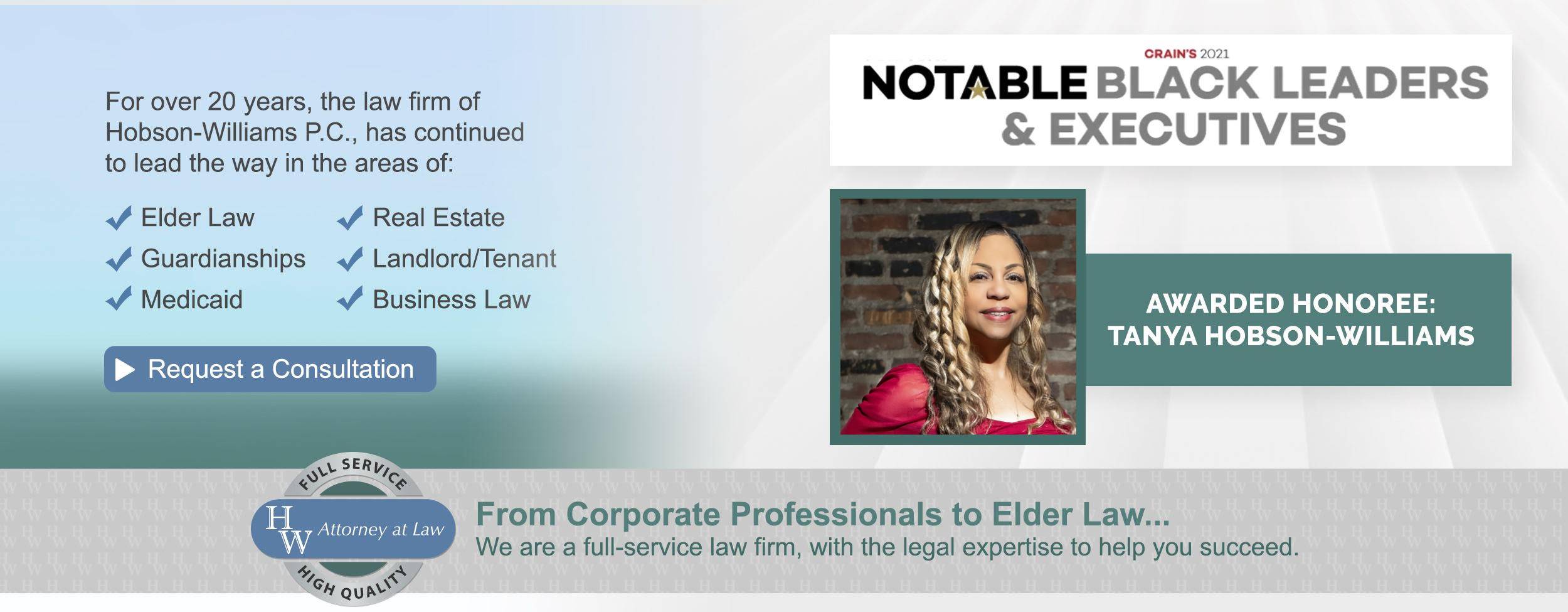

Whether for yourself or for a loved one, estate and elder law planning can be overwhelming and emotionally taxing. The legal professionals at Hobson-Williams, P.C. will advise you on the options available to you, and help you establish a plan that best suits your needs. Call (718) 210-4744 or visit our contact page to speak to one of our attorneys and learn how Hobson-Williams, P.C. can help you gain the peace of mind that comes from being prepared for the future.

Thanks for helping me understand how having an estate plan helps you ensure that your loved ones can receive the support they need even when you’re not around. I wanted to learn about estate planning after seeing the term in a movie I watched with my girlfriend. I’ll consider this advice if I end up needing something similar in the future.

It’s nice that you pointed out how there are certain steps you could take to provide for your loved ones through your estate planning. I was reading an article about estate planning earlier and I learned about estate planning special needs trusts. It seems pretty useful, so I could understand why some would opt to have it.