As individuals begin to age, long-term care services and how to finance them become major concerns. Many turn to Medicaid to pay for their long-term care needs. Medicaid is a joint Federal and State funded program that provides medical insurance and long-term care payments on behalf of middle- to low-income individuals, including those who are elderly and disabled. However, since Medicaid eligibility is determined by the combined value of income and assets, gifting money and joint accounts may impede a person’s ability to secure Medicaid benefits.

As individuals begin to age, long-term care services and how to finance them become major concerns. Many turn to Medicaid to pay for their long-term care needs. Medicaid is a joint Federal and State funded program that provides medical insurance and long-term care payments on behalf of middle- to low-income individuals, including those who are elderly and disabled. However, since Medicaid eligibility is determined by the combined value of income and assets, gifting money and joint accounts may impede a person’s ability to secure Medicaid benefits.

Whether a penalty period results from the transfer or gifting of money to another person depends upon whether the individual is applying for Chronic Care Medicaid or Community Medicaid. For Chronic Care Medicaid, which provides coverage for long-term care services in a nursing home facility, there is a five-year look-back period. This means that, if an individual transfers or gifts money within five years of applying for Chronic Care Medicaid, he or she will face a penalty period. For Community Medicaid, which provides support for long-term care in the home, there is no look-back period when applying for coverage and the applicant will not face a penalty period for transferring or gifting money.

Joint accounts may also hinder an individual’s ability to secure Medicaid benefits. When an individual applies for Medicaid coverage for long-term care services, the state will assess the person’s income and assets to see if they qualify for public benefits. Even though the bank account has two names on it, the state presumes that the content of the joint account belongs to the Medicaid applicant, regardless of who contributed money into the account. The state will presume that the account belongs to the Medicaid applicant unless it is proven that the individual did not contribute money into the account. If the Medicaid applicant is unable to overcome the presumption, then 100 percent of the account’s contents are considered to belong to the Medicaid applicant.

Whether the state presumes that all contents of a joint account belong to the Medicaid applicant depends upon what type of joint account it is. If the account is a convenience account, the entire account will be presumed to belong to the applicant. However, if the funds are placed in a joint stock or brokerage account, then there is no presumption that the account belongs solely to the Medicaid applicant. In this instance, each individual is presumed to own half of the joint stock or brokerage account.

Individuals who are applying for Community Medicaid may be able to eliminate income over the state income limit by placing the excess income into a Pooled Income Trust. When applying for Community Medicaid, an applicant’s resources may be “spend down” by placing them into a trust or by making transfers. Under current Medicaid regulations, there are certain asset transfers into trusts that may be identified as exempt income when determining Medicaid eligibility. Transferring assets should never be done without first consulting a qualified Elder Law attorney familiar with transfer of assets rules.

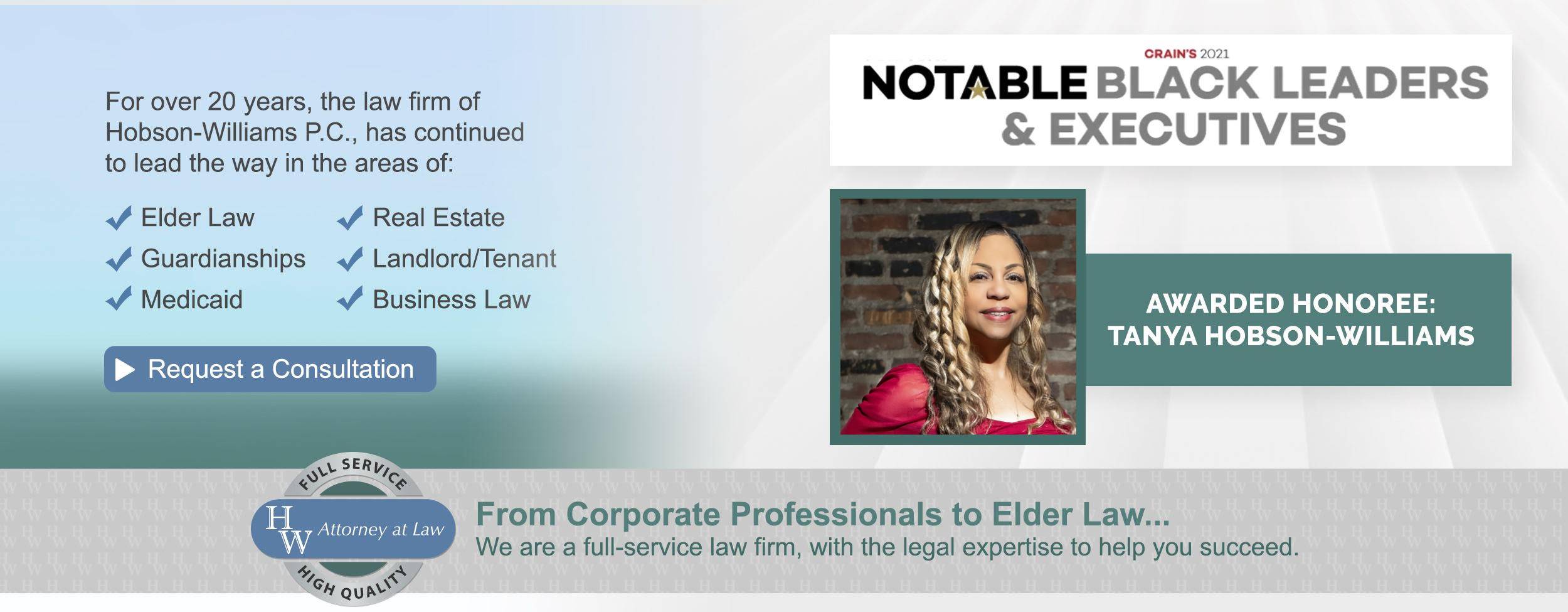

As you or your loved ones reach retirement age, it is important to determine what long-term services you will need and how you will pay for them. The New York Elder lawyers at Hobson-Williams, P.C. are experienced in assisting elderly and disabled individuals meet Medicaid income eligibility standards and will help establish trusts and assist with exempt transfers to protect their assets. For more information or to schedule a consultation, call our New York elder law and estate planning office at (718) 210-4744 or fill out our contact form.

If someone is on medicaid and they are taking care of an elderly parent and their name is on their parents bank accounts as POA and POD, are those accounts exempt from the assets of the person with Medicaid.