Although not the most widely known or understood estate planning tool, a trust may be extremely helpful for your personal needs. While a will might be fine for some, the advantages of a trust can be preferable for some estates. Here are five major reasons you should consider a trust for your estate planning needs:

- It avoids many of the problems of probate

- One of the most arduous aspects of administering an estate is the process of probating a Will. Probate involves filing the Will and having the clerk review the will and accompanying documents to ensure the Will’s validity and to have the Executor appointed to manage the estate assets. Not only is probating a Will a long process, but it can be an expensive one, even if no problems arise. Property held in a trust, however, is considered non-probate, meaning it avoids most of these problems, saving you precious time and money.

- It may protect you from some taxes

- When your estate is distributed under a Will, it may become subject to a number of state and federal taxes. Additionally, the estate may be liable to pay for any taxes the decedent did not pay during his/her lifetime. These taxes can reduce estate assets and therefore reduce the distribution to estate beneficiaries. Funds held in a trust, however, could be protected from some of these taxes, ensuring the estate goes to its intended beneficiaries, not the government.

- It can protect your estate from creditors

- In much the same way that a trust can protect your estate from taxes, it can also protect your estate from creditors. This is important because the people you owe money to may try to get your estate to pay back any debts you left unpaid while you were alive. When your property is held in a trust, creditors will have a hard time obtaining trust assets. Therefore, assets are less likely to go into the pockets of debt collectors.

- It is distributed automatically

- Before the property in a Will can be distributed, the Will must be probated. Thereafter, the designated executor of the estate must collect all estate assets and then distribute them according to the terms of the Will. This is a process that can take months or years. However, property held in a trust can be distributed according to the terms of the trust agreement by the trustee without having to go to court. Not only does this process avoid the time, effort and expense involved with probate, it allows the property in the trust to be distributed automatically, without waiting for the court’s approval.

- It can benefit you while you are still alive

- There are two primary types of trusts used in estate planning. One, the testamentary trust, only comes into effect after you pass away. However, a living trust (also known as an inter vivos trust) can come into effect while you are still alive. A living trust allows you to see many of the benefits of a trust during your lifetime, and when you pass away, it automatically distributes your property to your beneficiaries. A living trust is not appropriate for everyone and you should consult an attorney before you attempt to create one.

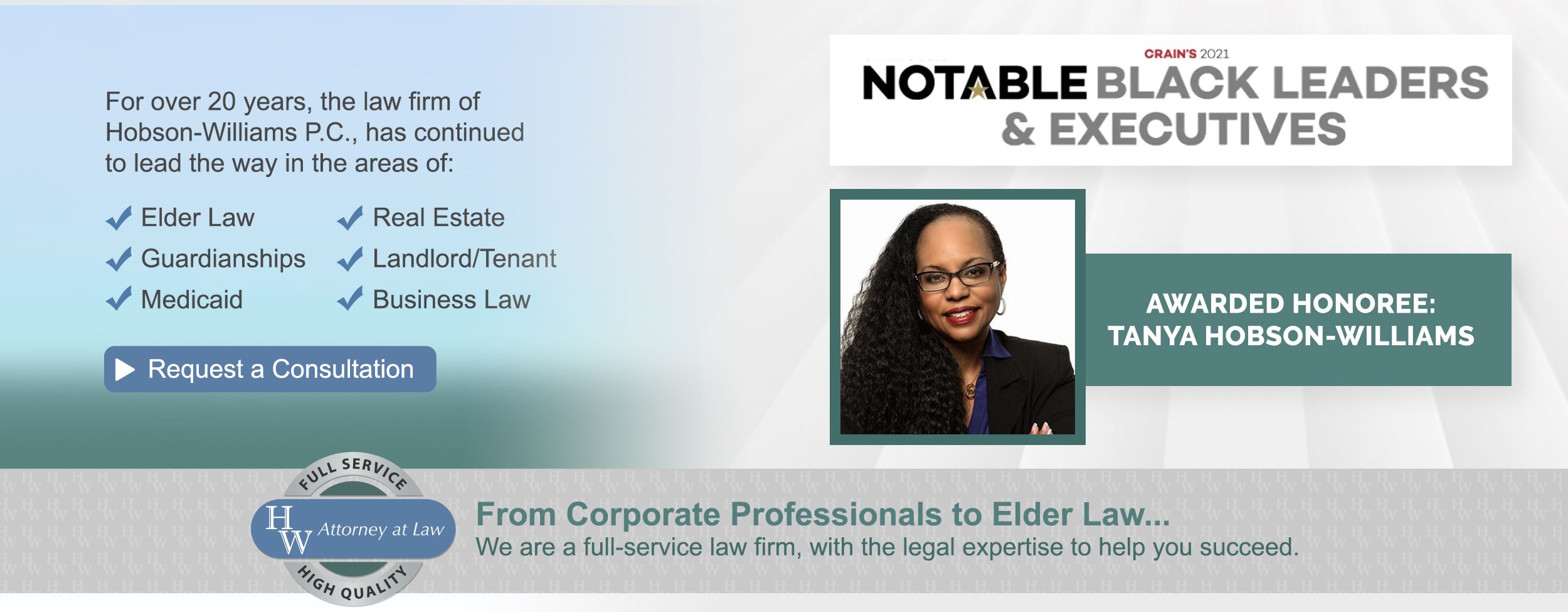

Whether for yourself or for a loved one, estate planning and elder law matters can be overwhelming and emotionally taxing. The legal professionals at Hobson-Williams P.C. will advise you on the options available to you and help you establish a plan that best suits your needs. Call (718) 210-4744 or visit our contact page to speak to one of our attorneys and learn how Hobson-Williams P.C. can help you gain the peace of mind that comes from being prepared for the future.

I was not aware until I read your information about how an estate put under a will can be subject to state and federal taxes. It can also be used to pay taxes the decedent didn’t pay while alive. It was good to read about how funds in a trust could be spared some of these taxes because it goes right to the beneficiaries. I have accumulated a lot of assets during my career and I don’t want to compromise it by not having them go straight to my children. Since I remarried, I will need to make sure that it is my family who benefits rather than those who were brought in after the properties were already accumulated. I will be calling an estate planning lawyer before summer to start the protection of these assets.