As Americans grow older and with a majority of the older population now entering retirement, the need for income sufficient to cover expenses becomes greater. While there are programs such as Medicare, Medicaid, Social Security, and Supplemental Security Income, that help seniors with income and healthcare, those programs may not be enough for some individuals to pay for their monthly expenses or healthcare costs. There is another option that is available to many Americans over the age of 62, such as a reverse mortgage.

A reverse mortgage, or a home equity conversion mortgage, allows homeowners over the age of 62 to convert a percentage of their equity stemming from their homes to cash. Here, a homeowner will relinquish a portion of their equity in their home in exchange for regular, monthly payments from a lender.

This process was originated many years ago to help low income Americans accumulate wealth in their homes to cover basic, monthly living expenses, such as health care, groceries, medication, and utilities. This specific type of loan does not place restrictions on what the money can be used for. Also, unlike a traditional loan, the proceeds from a reverse mortgage do not have to be paid back by the borrower until they decide to sell their home, or the home is permanently vacated.

According to an article released by the University of Illinois, some of benefits that are attributed to reverse mortgages include:

- Being able to remain in a family home for the remainder of your life;

- Not being taxed on the income from a reverse mortgage;

- Not having the payments from a reverse mortgage affect Social Security or Medicare benefits; and

- The value of the home being the sole factor in determining eligibility.

The article also discusses some disadvantages of a reverse mortgage, which include:

- If the owner passes away or goes to a nursing home long term, the loan must be repaid before the title of the home can be passed to the borrower’s heirs;

- Possible foreclosure action when the owner permanently vacates the home;

- The possibility of payments affecting Supplemental Security Income and Medicaid;

- Possible inability to have money for the heirs of your estate after repayment of the reverse mortgage;

- Compounding interest on the reverse mortgage is not tax deductible until the repayment of the loan is complete, among others.

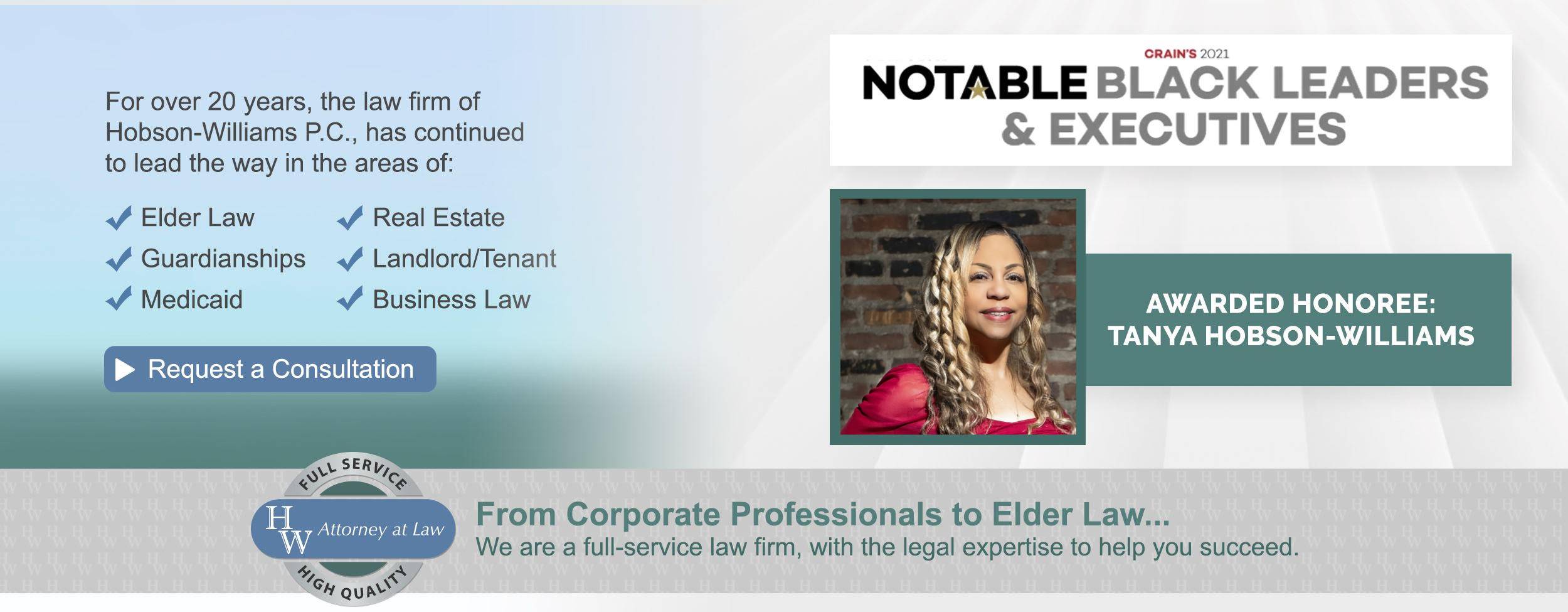

If you or a loved one are considering applying for a reverse mortgage or are in a dispute which involves your current reverse mortgage and are facing foreclosure on your home, it is best to contact an experienced New York reverse mortgage foreclosure and elder law attorney, who can guide you and help you remain in your home. The attorneys at Hobson-Williams, P.C.are skilled in all aspects of reverse mortgage foreclosures and elder law, and are dedicated to representing clients with diligence and compassion. To speak to an attorney or to schedule a consultation, call 866-825-1LAW.