Choosing the Right Business Entity Part I:

Sole Proprietorships and Partnerships

The decision to start a business isn’t something that is formed overnight; it takes a lot of thought and courage to decide to venture off on your own and create your own company. However, you can’t simply open up your doors the minute you come to the realization that you want to start your own business; there is a large gap in between the decision and opening day. Before you open your doors, you must determine what type of business you’d like to start.

Sole Proprietorship

A sole proprietorship is one of the most popular forms of businesses. This is because this type of business has only one owner and is relatively easy to start-up. A large benefit of sole proprietorships is that the owner gets to keep all the profits, after taxes and expenses, and does not have to split the remaining balance with a partner. Another key advantage of sole proprietorships is that the business owner gets to make all the decisions without having to consult with anyone else. Also, these business owners are only taxed once. Thus, there is no need to file a separate business tax return, as all the income generated can be filed on your own personal tax return.

However, a major disadvantage of sole proprietorships is that these businesses have unlimited liability to the company. With this, the owners can be held personally liable for lost profits, damage to property, and any other debts. Another disadvantage is that it is more difficult to raise start-up capital and continue to raise capital over the course of time. A sole proprietorship is generally a smaller business and is not publicly traded meaning that they cannot sell shares of their company in the marketplace to generate capital. Lastly, it is more difficult to dispose of the company when the owner decides to sell. This is because the company is completely tied to the owner. If the original owner passes away, the business typically folds.

Partnership

A partnership is a type of business agreement that is formed between two or more individuals. There are two different types of partnerships that entrepreneurs can create:

- General Partnerships; and

- Limited Partnerships.

General Partnerships

A general partnership is a type of partnership where each of the partners has equal responsibility and are involved in the day-to-day operation of the business. There are a few advantages and disadvantages to this type of business. One advantage is that they are relatively easy to form. Aside from being easy to form, it is also easier to raise capital, as there are two or more owners in the business. With more people comes more knowledge and ideas that will arise as well. Lastly, owners of the business are only taxed once on their personal income tax (they do not need to file separately for the business).

Along with the advantages come a few disadvantages. As mentioned above for sole proprietorships, owners of general partnerships also endure unlimited exposure to liability if something should go wrong. Also, it is relatively difficult to sell the partnership, as each owner must unanimously consent to the sale and transfer of ownership. Lastly, it can be more difficult to make executive decisions, as there is more than one person that must agree on the decision.

Limited Partnerships

A limited partnership is a type of partnership where there is one main general partner that is involved with the day-to-day operation of the business with one or more limited partners, who are not involved in the daily operations and may be limited in their input to the business. In this type of partnership, the limited partner has limited liability exposure, meaning that if something were to go wrong with the business (legally and/or financially), the personal assets of that limited partner are safe and cannot be subject to a lawsuit. This makes limited partnerships more appealing to investors, as their personal assets cannot be put in jeopardy and they have limited liability for any business debts incurred. Just like the general partnership, limited partnerships allow for their owners to be taxed once as personal income.

Limited partnerships, like general partnerships, still hold the general partner liable for any business debts incurred. If a limited partner does decide to become more involved in the day-to-day operations, then they will also be held liable once they move from limited partner status to general partner status. Lastly, a Certificate of Limited Partnership must be filed with the Department of State and paid for before the partnership starts to operate.

In addition to sole proprietorships and partnerships, there are several types of corporations that an entrepreneur can choose for their business, including C corporations, S corporations, Limited Liability Companies, Professional Limited Liability Companies, among others. There will be explored in Part II of this article.

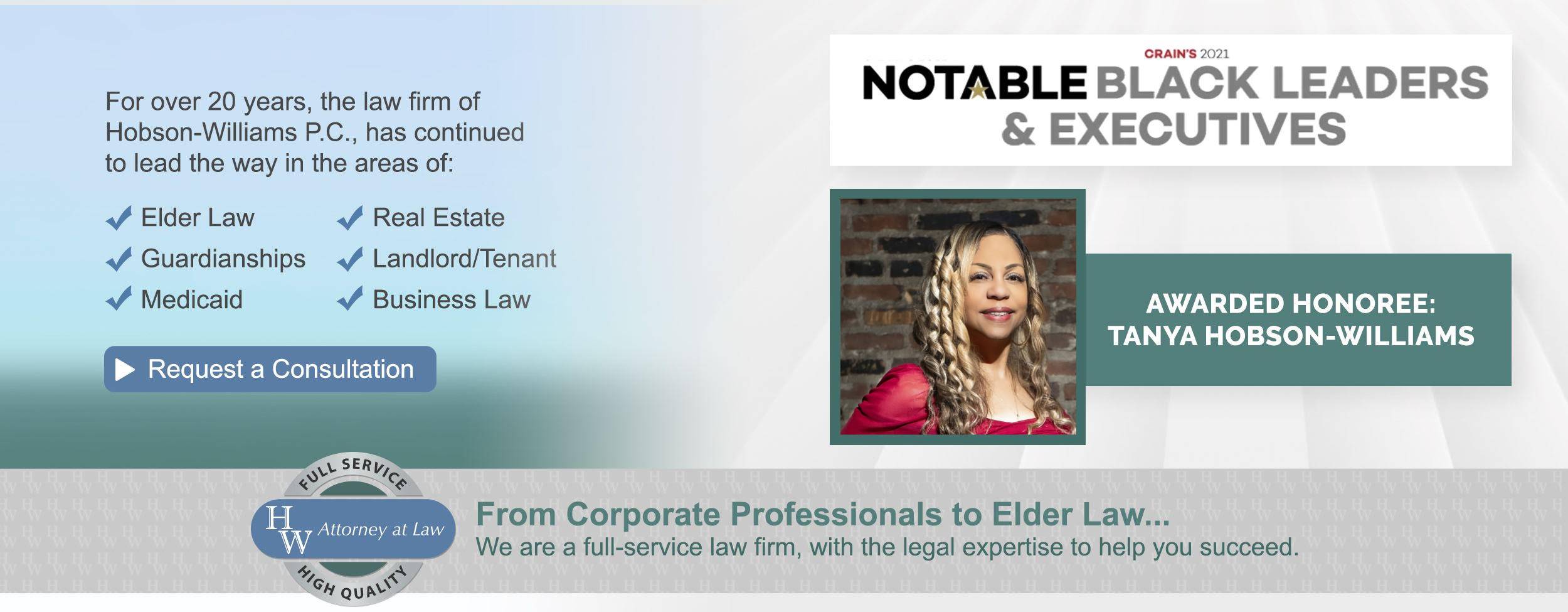

From determining what type of business is right for you, to the initial startup of your business, to any issues you may encounter along the way, you can rely on Hobson-Williams, P.C. for effective and diligent representation in all your business’ legal matters. The attorneys at Hobson-Williams, P.C. are skilled and knowledgeable in the area of business law and commercial transactions. Contact us at (718) 210-4744 for the quality representation that you deserve.