As of April 1, 2017, the New York State estate tax exclusion increased to $5,250,000 from the $4,187,500 exclusion amount in effect since April 1, 2016. As of January 1, 2017, the federal estate tax exclusion is $5,490,000. The New York State exclusion amount will remain in effect until December 31, 2018 and, as of January 1, 2019, this amount will be indexed for annual inflation.

As of April 1, 2017, the New York State estate tax exclusion increased to $5,250,000 from the $4,187,500 exclusion amount in effect since April 1, 2016. As of January 1, 2017, the federal estate tax exclusion is $5,490,000. The New York State exclusion amount will remain in effect until December 31, 2018 and, as of January 1, 2019, this amount will be indexed for annual inflation.

In 2000, New York state repealed its gift tax. For New York State residents, this meant that gifts made to family and friends over the course of their lifetime would not be included in their gross estate. However, in 2014, a three-year look back period was enacted for gifts made between April 1, 2014 and January 1, 2019. This means that a three-year look back will take place upon a resident’s death and any gifts made within that time period would be included in the estate for the purpose of calculating the estate tax in New York. There are certain gifts that are excluded from the three-year look back period. They are as follows:

- Gifts made when the decedent was not a New York State resident.

- Gifts made before April 1, 2014.

- Gifts made on or after January 1, 2019.

- Gifts that are taxed under a federal estate tax law.

In 2017, for federal gift taxes, annual gifts in the amount of $14,000 per person are allowed without having to report these gifts on a tax return. This also applies to New York State. Federal estate tax law contains a portability provision. This provision allows unused estate tax exemptions of a married tax payer to transfer to a surviving spouse. In New York State, there is no portability provision within the estate tax laws. Without this provision, the way in which a couple maintains title to their assets may affect the amount of estate tax that will be paid in New York State upon a spouse’s death.

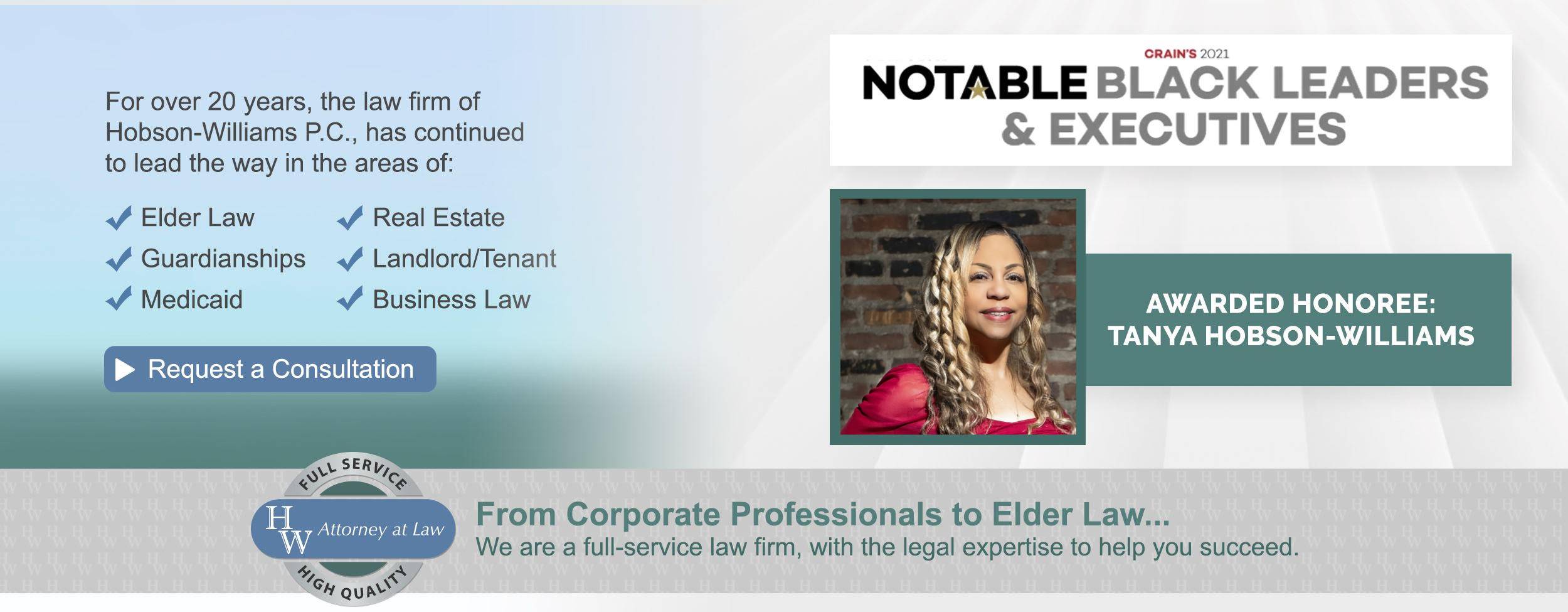

Even though the estate tax exclusion amounts are increasing, estate planning is still often necessary and complex. If you are looking to make changes to an estate plan or gifting strategy, it is important to contact an experienced attorney that concentrates their practice in these matters. The lawyers at Hobson-Williams, P.C. are skilled in all aspects of Trusts, Estates and Elder Law and are dedicated to representing its clients with diligence and compassion. Contact the experienced New York attorneys at Hobson-Williams, P.C. for a consultation by calling (718) 210-4744 or by filling out our contact form.